The 2020 Top Venture Capital-Backed Companies List reflects a range of success stories and COVID-era challenges among Kansas City’s community of growth-stage, venture-backed companies.

More ahead

The list of Kansas City’s Top VC-Backed Companies is the jumping-off point for a series of Startland News analysis pieces, breaking down some of the trends behind the numbers. Click here to subscribe to Startland News and get these follow-up reports as they go live.

The list — updated annually by Startland News and its parent organization, Startland — shows that while few companies were spared from COVID-19’s impact, many of Kansas City’s leading entrepreneurs continued to grow their businesses and employee counts — individually and collectively passing new milestones for the region despite the pandemic.

For example, eight companies on the list averaged at least 500 percent annual revenue growth rate over the past two years; HCI Energy, SquareOffs, Kenzen, Transportant, Bungii, Homebase, LaborChart, and ELIAS Animal Health.

And fintech global powerhouse C2FO followed a massive funding round in 2019 with a hiring spree that saw its employee count jump to 470 FTE, a more-than-110 percent increase from 223.5 FTE in 2019. (Leawood-based C2FO’s local employee total alone grew by nearly 90 percent.)

Click here for more specifics on the leading takeaways from this report.

It’s important to note this is not a “top 10” list but a comprehensive data set of self-reported information from every company that meets the following criteria and responded to our call for data:

- Raised at least $1 million;

- Raised capital from at least one institutional venture investor;

- Raised a round of capital within the past three years (since July 1, 2017);

- Pre-exit; and

- Physically headquartered in the greater Kansas City metro area as defined by the KCADC.

The list is made possible through financial support from the Ewing Marion Kauffman Foundation, C2FO and Entrepreneurs’ Organization, a global peer-to-peer network of business owners.

Click here to see notable statistics pulled from this year’s data.

Click here to see the 2019 Top VC-Backed Companies List.

Finally, the default order for the list is the KC Growth Index (also explained below the list) which is an effort to create a fair and significant way to order the companies. Not all companies responded to all prompts, resulting in some instances of undisclosed or insufficient data.

Is your company eligible and missing from the list? Click here to fill out a quick eligibility and data form and email Tommy Felts.

NOTE: On desktop or laptop, you can sort by the different columns, click the “expand” icon by each company name for a company summary, and click “view larger version” in the bottom right corner for a full-screen view. On mobile, click on each company for a company summary.

Note: SMRxT qualifies for the 2020 list, but did not confirm its information.

* denotes new company on the list

Click here to understand how the KC Growth Index is calculated.

Notable statistics

- 66 total companies; 14 new companies, nine companies dropped from the list.

- 29 companies were founded between 2012 and 2014; 11 before and 26 after.

Average company profile:

- 42.7 employees (up 43.3 percent from 29.8 in 2019)

- $20.56 million raised (up 17.8 percent from $17.46 million)

- 52.9 percent raised from Kansas City-area investors (down slightly from 53.2 percent)

- 274 percent two-year average annual revenue growth (up from 277 percent)

- 6.1 years old (up slightly from 6.0)

Complete list totals:

- 2,092.5 total employees (up 25.4 percent from 1,669 in 2019)

- 1,502 Kansas City employees (up 18.6 percent from 1,267)

- $945.80 million raised (up 4.14 percent from $908.18 million)

- $237.67 million raised from KC-area investors (down 0.53 percent from $238.94 million)

Funding:

- The 10 companies with the most reported capital raised, on average raised 23 percent from Kansas City-area investors, as compared to a 59.5 percent average for the rest of the list — indicating companies tend to primarily raise outside funding as they grow.

- Kansas companies that reported funding totals have raised more than twice as much capital ($30.19 million) on average than Missouri companies ($14.21 million).

- Kansas companies have on average raised 62.96 percent of their funding from Kansas City-area investors as compared to 43.61 percent by Missouri companies.

Missouri vs. Kansas:

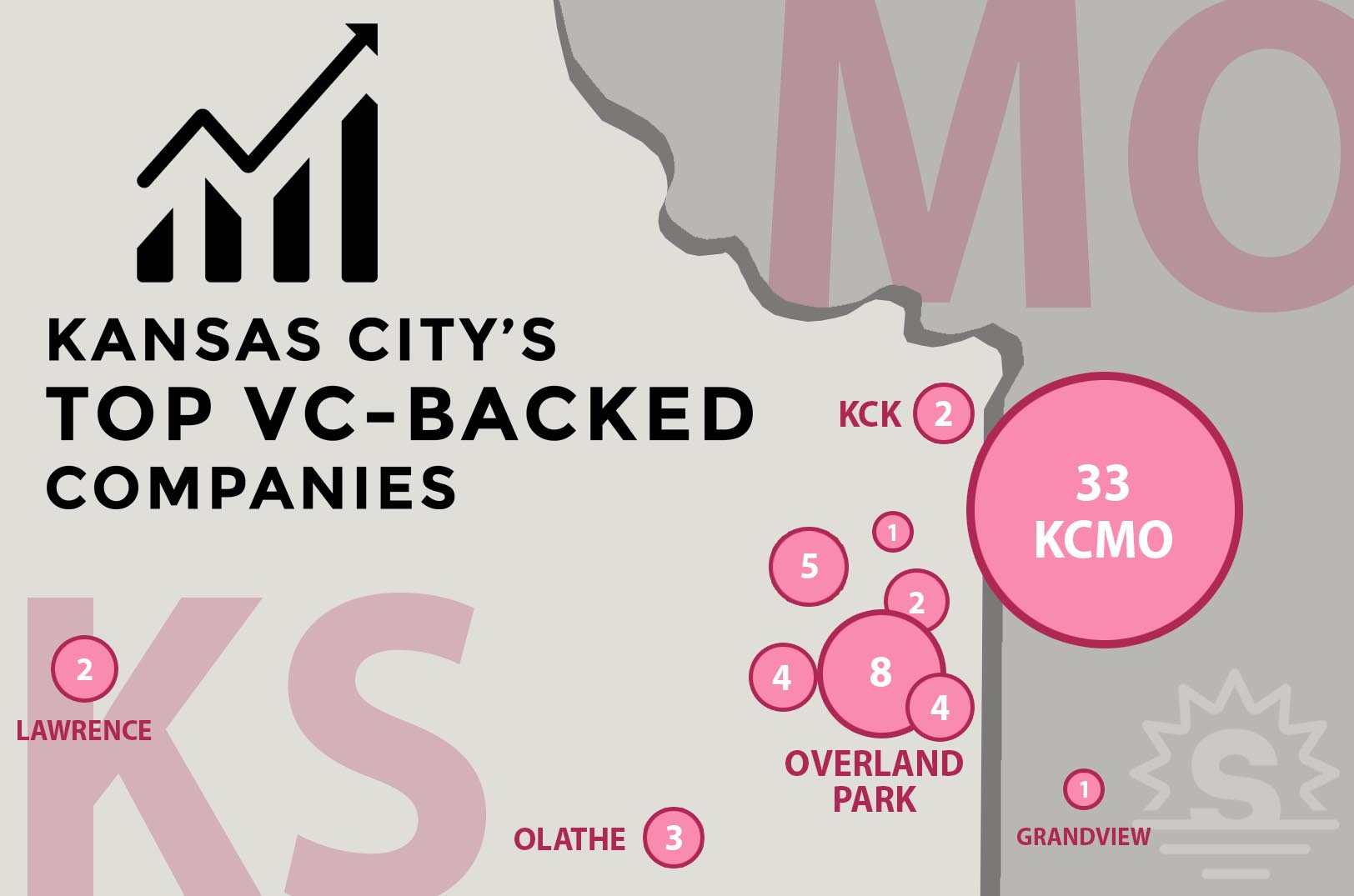

- Of the 65 companies on the list, 34 are headquartered in Missouri (33 specifically in KCMO), and 31 in Kansas.

- Kansas and Missouri companies have a relatively even average two-year growth rate (269 percent for Kansas compared to 278 percent for Missouri).

- Kansas companies average 59.6 percent more employees than Missouri companies — averaging 54.9 employees to 34.1 employees respectively.

Employees:

- Nine companies grew their staff by at least 50 percent in the past year: Artio, C2FO, Daupler, Spear Power Systems, backstitch, Scollar, Tesseract Ventures, Homebase, and BacklotCars.

- Six companies added at least 20 employees in the past year: C2FO, BacklotCars, Bardavon, Rx Savings Solutions, Spear Power Systems, and PayIt.

- One company reached the 100-employee milestone — PayIt — bringing the total to six 100-employee companies: C2FO, Bardavon, BacklotCars, Rx Savings Solutions, Mylo, and PayIt.

- Four companies reached 20 employees: Homebase, Tesseract Ventures, backstitch, and DivvyHQ — bringing the total to 23 companies with at least 20 employees.

- 2020 companies have 1,502 total Kansas City employees, 235 more than the 2019 list.

KC as second HQ:

- Two VC-backed companies that didn’t qualify for the list — SafetyCulture (Sydney, Australia) and TrueAccord (San Francisco) — were excluded because Kansas City is not their primary headquarters, though they boast a significant operational presence locally at their respective “second” headquarters.

- If the two were included in the count, the number of Kansas City employees would jump by 189.5, thanks to 127 local workers at TrueAccord and 62.5 at SafetyCulture.

- The duo also would push the list’s overall funding total past the billion-dollar mark to $1,092.9 million, with $100 million attributed to SafetyCulture and $47.10 million for TrueAccord.

- Based on their KC Growth Index scores, SafetyCulture (50.550) would be ordered in the list between C2FO (80.650) and Bardavon Health Innovations (32.770); and TrueAccord (30.760) would be ordered between Bardavon and PayIt (27.747).

- With its Lenexa-based local financial services operation, TrueAccord would add a notch in the Kansas column, while Crossroads-based software company SafetyCulture would buoy the count for Kansas City, Missouri.

Demographics:

- Founder demographics:

- 131 founders

- 20 women (15.5 percent, up from 12.2 percent in 2019)

- 16 non-white (steady at 12.2 percent)

- CEO demographics:

- 67 CEOs (*DivvyHQ has co-CEOs)

- 11 women (16.7 percent, up from 12.9 percent in 2019)

- 7 non-white (10.4 percent, down from 11.3 percent)

COVID-19 relief:

- Of the 55 companies on the list that responded, 43 (78.2 percent) received some COVID-19 relief funding.

- Among those 43 receiving aid, 42 took advantage of the Paycheck Protection Program specifically.

- Of 13 largest companies by employee count, seven (54 percent) accepted PPP funding (though some already have paid it back voluntarily).

Click here to see the 2019 Top VC-Backed Companies List.

Explaining the KC Growth Index

STARTLAND established the KC Growth Index to organize this list in a fair and significant way. The evaluation system doesn’t solely prioritize capital raised, but instead creates a more comprehensive snapshot of venture-backed companies in the Kansas City area based on capital raised, number of employees, two-year average annual revenue growth rate and longevity.

The KC Growth Index calculation was tweaked this year so a company’s score is now comparable year-to-year. It is based on a 27.5-point scale but a company can exceed 27.5 points. For example, employee count is based on a 10-point scale with 100 employees equating to 10 points. However, if a company has 200 employees, they will be given 20 points.

The index is based on a formula that rates each company based on the self-reported data provided to Startland News and STARTLAND. The index takes into account four data points from each company.

- Total funding raised (10-point scale based on $50 million; in other words, $50 million raised equals 10 points);

- Current number of employees (10-point scale based on 100 employees);

- Two-year average annual revenue growth rate (5-point scale based on a sliding scale in relation to longevity, 1000 percent for two-year- old companies to 100 percent for 10-year old companies); and

- Longevity (2.5-point scale based on 10 years).

Each company’s four category scores are combined to compute their KC Growth Index score.

NOTE: Companies that didn’t disclose certain information received zero points in that particular category.