Kansas City has made significant strides when it comes to improving access to early-stage capital, though its relative volume still lags other startup hubs, according to a recent report.

The Kansas City metro’s increase in total capital raised represents the third-largest growth among 27 major U.S. metro areas.

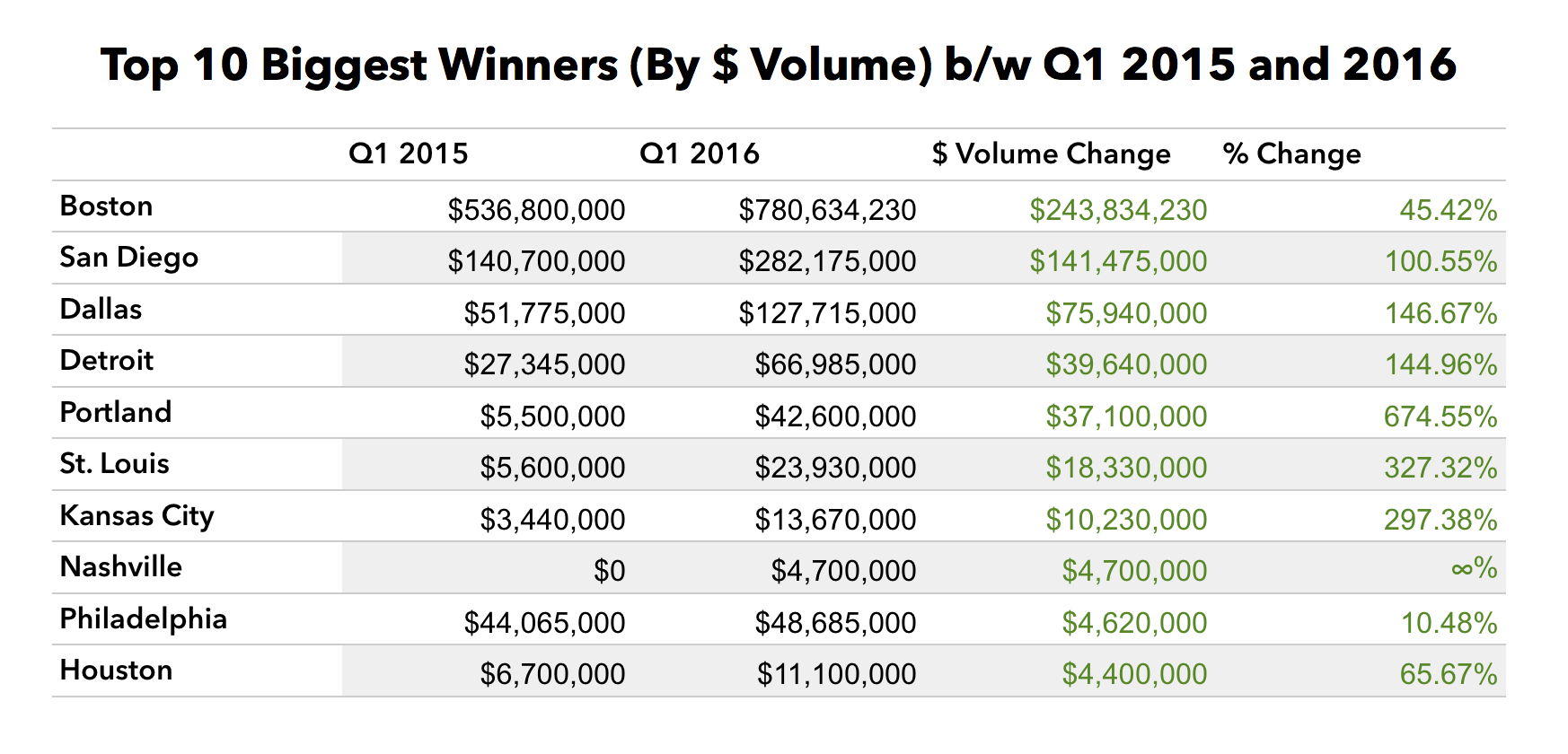

In the first three months of 2016, Kansas City has boosted its total capital raised by about 297 percent when compared to the same time period in 2015, according to a Mattermark report. The report notes that in the first quarter of 2016, Kansas City startups have raised $13.67 million compared to only $3.44 million in Q1 of 2015.

Mattermark tapped such sources as Crunchbase, AngelList and its own research department.

If Kansas City can continue to build investment funds, attract additional capital and build companies based on game-changing ideas, the area is laying the foundation to become a Midwest center for entrepreneurship, said Maria Meyers, founder of KCSourceLink. Meyer’s organization, which serves as an area entrepreneurial resource hub, has been a central force in growing early-stage risk capital.

Asked why Kansas City was able to improve its total capital raised, Meyers said the community has effectively worked together to address what’s been an ongoing challenge.

“Building better access to capital has become part of the agenda for Kansas City,” Meyers said. “We are getting more organized and more connected around financing early stage businesses. People are talking about deal making, which is increasing visibility and encouraging others to invest. We see both local funds building and funds from outside of the community taking a stronger interest in the region, and these groups are beginning to invest.”

The Kansas City metro’s increase in total capital raised represents the third-largest growth among 27 major U.S. metro areas. Portland topped the list in terms of growth by volume in dollars, snagging $42.6 million in Q1 of 2016 — a 675 percent increase from last year’s mark of $5.5 million. St. Louis posted the second-highest increase, snagging $23.93 million in 2016’s first three months — a 327 percent increase from last year’s $5.6 million.

Image by Mattermark.

While a significant increase, Kansas City still considerably lags behind other major U.S. metros when it comes to total capital raised in the first quarter of 2016. Kansas City ranked No. 19 out of the report’s 27 metro areas.

Kansas City, however, did perform well for its proverbial weight class, so far beating out Atlanta, Houston and Salt Lake City. The Bay Area, as it usually does, dominated all other metros in total capital raised, snagging $1.74 billion in Q1 of 2016 — a decrease of 19.48% percent from last year’s $2.16 billion mark.

Mattermark’s Jason Rowley argues that while Kansas City’s total capital raised is dwarfed by startup hubs like Silicon Valley and Boston, it may do a better job retaining startups.

“Smaller ’emerging markets’ for startup investment seem largely unaffected by the bearishness in established startup hubs,” writes Rowley. “In general, these markets are not only seeing more deals, but a higher average check size for each deal. In cities like Kansas City, San Diego, St. Louis and others, companies that raised rounds in Q1 2015 raised fresh capital this year. In other words, these companies see no reason to leave home.”

To read the report, click here.