A bill extending Kansas’ popular Angel Investor Tax Credits scored its first victory Thursday, but legislators must make quick work of the measure if the program is to survive.

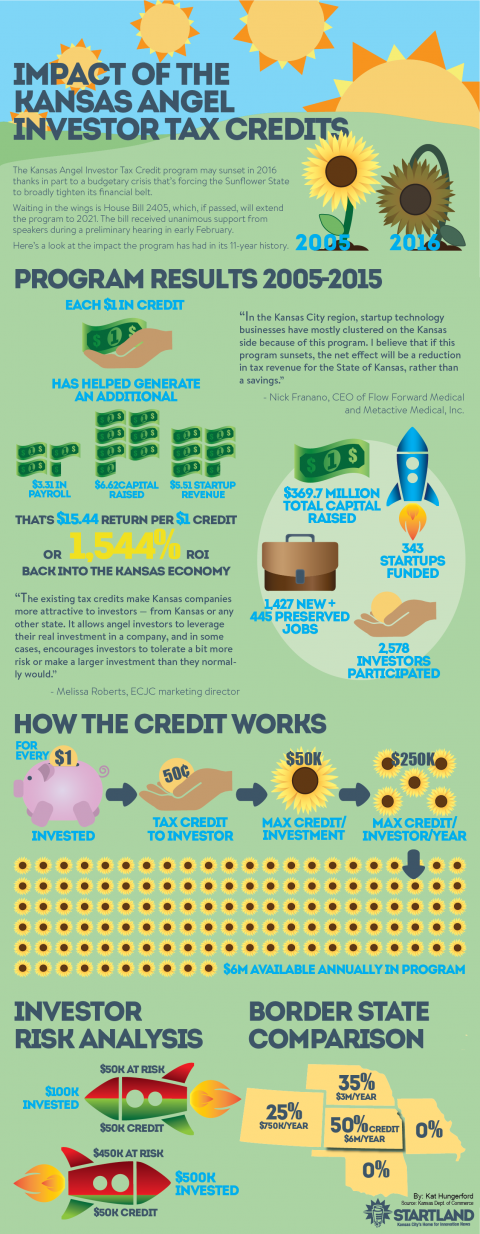

The Kansas House Committee on Taxation unanimously approved a measure to continue the program, which offers accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill — which is now a part of omnibus tax measure SB 149 — will head to the House floor for a vote. Kansas House lawmakers must approve the bill by Tuesday or it will have little time to be worked by a Kansas Senate committee and then voted on by the Senate at large.

While only among the first steps in renewing the bill, the House committee’s approval is a twofold victory, supporters say. Not only will the program have a chance to be voted on, but it also retains its current allocation levels of $6 million per year. Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — is the largest complicating factor for the future of the program.

Melissa Roberts, a key support organizer of the program, said that entrepreneurs’ vocal backing of the tax credits helped compel committee members to advance the bill.

“The advocacy of entrepreneurs and investors has been critical to advancing this bill, and will continue to be important to ensure its passage on the House floor,” said Roberts, marketing director for the Enterprise Center of Johnson County. “The economic impact of this program speaks for itself, but angel investment tax credits are competing with many pressing issues at the end of the legislative session. In the fight to extend the sunset of angel investment tax credits, every voice will help. ECJC is proud to be one of the organizations at the vanguard of the effort to preserve this critical entrepreneurial incentive.”

The popular program — tapped by more than 300 startups in its 11 years — has had a tremendous impact on the area startup community but is scheduled to sunset after 2016. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

The program also has rallied an impressive base of support in the Kansas City area, including dozens of entrepreneurs and industry organizations. One specific organization, BioKansas, is urging members to continue contacting legislators that will soon vote on the bill.

“If you haven’t been able to get involved yet, now is the time for that initial outreach,” the organization wrote in a recent email. “The talking points that have proved the most effective are the ROI to the state in terms of jobs, revenues and competitive advantage, and the fact that renewal of these incentives won’t actually impact the budget until 2018. Our message is resonating and it’s making a difference.”

For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.